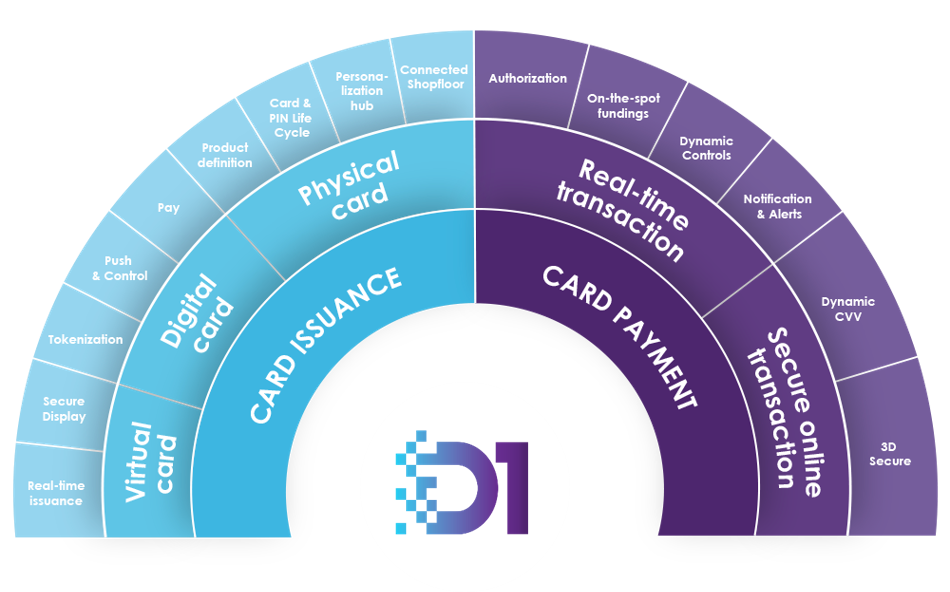

Our Digital First (D1) platform provides a set of "ready-to-use" services and tools, allowing the issuers to launch new digital first experiences "Digital First, Physical Later" and "Digital only" in their mobile banking application.

With our D1 platform, issuers can choose from multiple advanced services to drive the best banking and payment experience for their cardholders.

D1 SDK exposes UX level APIs to facilitate the integration of digital services into the issuer mobile banking application, a set of services is provided to enable the management of Virtual Card, Physical Card and the creation of Digital Card.

Before the bank application can use the D1 SDK to provide service to end user, two actions must be taken by the issuer:

- Card Registration: The card(s) issued from the CMS needs to be registered within D1 prior any action taken in the bank application.

- Authorization: D1 SDK needs to take the confirmation from the bank application that the user is authorized to access D1 service.

The expectation from D1 is the end user as been authenticated by the bank and be granted to access to a set of D1 services.

For more information, please refer to the

D1Task.login(byte[], Callback).

| Package | Description |

|---|---|

| com.thalesgroup.gemalto.d1 |

This package provides generic structure for D1 features, such as callback, exception, configuration and initialization.

|

| com.thalesgroup.gemalto.d1.card |

This package contains common data structure for both Virtual and Digital card.

|

| com.thalesgroup.gemalto.d1.d1pay |

D1 Pay enables an eligible card (virtual or physical card previously registered) to be digitized

and perform contactless proximity (NFC) payment using the mobile banking application.

|